All resident tax payers shall implement the updated Tax on Salary on their payroll from January 2017 onwards. Tax on Salary shall be filed completely and submitted to the tax department no later than 20th of the following month. This means that this new amendment will be implemented for January’s monthly return and will be filed and paid by February 20th.

In the previous year, monthly tax returns were due on the 15th of the following month except for VAT, which was due by the 20th. Each tax payer needed to submit twice monthly which was a burden; the Royal Government identified this issue and finally adjusted the law so that all monthly tax returns will only be submitted once, by the 20th.

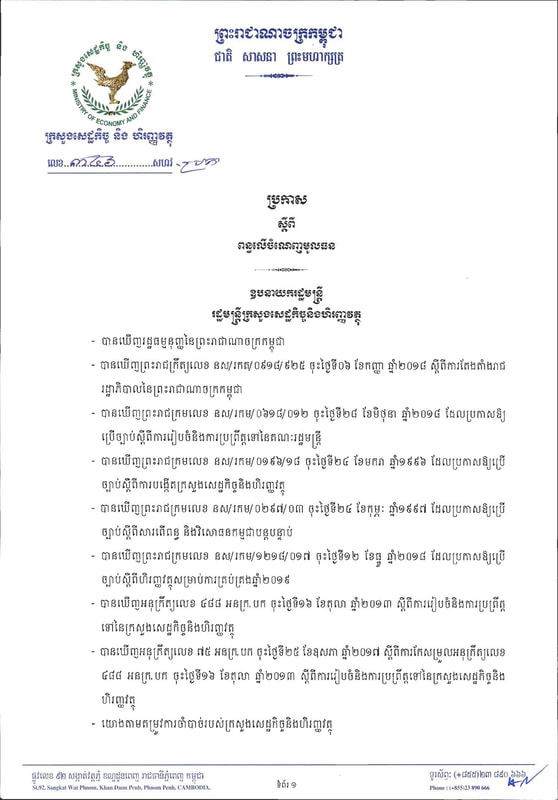

2. Increased rate for TOS

With this new amended law, the Royal Government has expanded the range within the 0%-10% category; 15%-20% remains the same. The minimum rate for TOS now starts from 250 USD; previously, it was 200 USD. See the rates below.

A: 0 - 250 USD=0%

B: 250 -350 USD =5%

C: 350-2,125 USD=10%

D: 2,125- 3,125 USD=15%

E: 3,125 USD < =20%

New rates in US Dollars (exchange rate: $1=4,000 KHR). Please note that the exchange rate will vary from time to time. See the exchange rate from the General Department of Taxation’s website if needed.

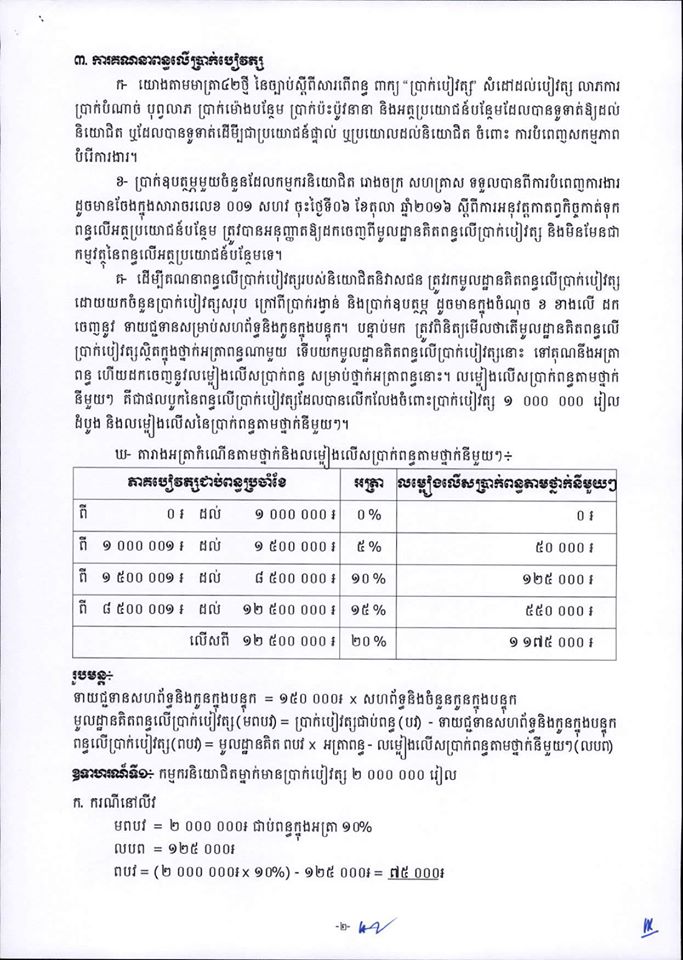

3. Allowance for spouse and dependent children

The government has decided to increase the basic deduction on TOS for 1 spouse (unemployed) and dependent children from 18.75 to 37.50 USD. This is a huge difference, since the deduction is two times greater than last year.

If you have any questions or inquiries concerning monthly and annual tax returns, please feel free to contact Making It Easy.

Kimsophat KONG, founder and CEO

[email protected] | +85512914201

Reference: Ministry of Economy and Finance/No.017 សហវ អពជ

RSS Feed

RSS Feed